Loading

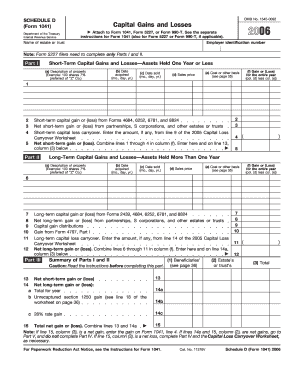

Get 1545-0092 Schedule D (form 1041) Department Of The Treasury Internal Revenue Service Capital Gains

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1545-0092 SCHEDULE D (Form 1041) Department Of The Treasury Internal Revenue Service Capital Gains online

This guide provides clear and comprehensive instructions for filling out the 1545-0092 SCHEDULE D (Form 1041). Designed to assist users with varying levels of experience in digital document management, this step-by-step approach ensures you can complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin with Part I: Short-term capital gains and losses. In the fields provided, list the description of the property, the date acquired, and the date sold. Enter the sales price, cost or other basis, and calculate the gain or loss for the entire year by subtracting the cost from the sales price.

- For each short-term transaction, repeat the process across the provided lines. Combine your results from lines 1 through 4 and enter the net short-term gain or loss in column (f) at the end of Part I.

- Proceed to Part II: Long-term capital gains and losses. Similar to Part I, fill in the description, date acquired, date sold, sales price, and cost or other basis. Calculate the gain or loss as before.

- Complete the summary of net gains or losses by combining the results from Part I and Part II in Part III. It is essential to follow the instructions carefully to ensure accurate reporting.

- If there is a net gain, refer to the instructions to record this on Form 1041, otherwise continue to Part IV for capital loss limitations.

- In Part IV, enter the smaller loss amount on Form 1041 line 4. If the calculated loss exceeds $3,000, complete the Capital Loss Carryover Worksheet.

- If applicable, complete Part V to compute taxes based on maximum capital gains rates. Follow the specific instructions provided in the form for accurate calculations.

- Once all sections are filled out correctly, save your changes. You have the option to download, print, or share your completed form as needed.

Take the next step in your document management journey by completing your forms online with confidence.

If Form 1041 is e-filed, then any Schedule D (Form 1041) and Form 8949 that are part of the return must also be e-filed. Any reference in these instructions to “you” means the fiduciary of the estate or trust. These instructions explain how to complete Schedule D (Form 1041).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.