Loading

Get Wi 4466w 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI 4466W online

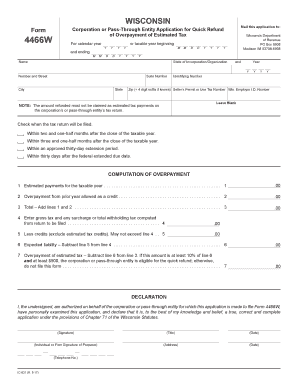

Filling out the WI 4466W form online can streamline your application for a quick refund of overpayment of estimated tax. This guide provides step-by-step instructions to help ensure that your application is completed accurately and efficiently.

Follow the steps to successfully complete your WI 4466W application online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the calendar year or taxable year for which you are filing the application. Ensure that the dates are formatted correctly.

- Fill out your corporation or pass-through entity name, state of incorporation or organization, and the year of establishment in the specified fields.

- Provide your identifying number, seller’s permit or use tax number, and Wisconsin employer identification number, leaving any blank fields as instructed.

- Indicate when your tax return will be filed by checking the appropriate box regarding the time frame.

- Complete the computation of overpayment section. Input your estimated payments and overpayment from the prior year, adding these values to get the total.

- Enter the gross tax and any surcharge or total withholding tax from your return in the corresponding section.

- Deduct the credits (excluding estimated tax credits) from the gross tax to determine your expected liability.

- Calculate the overpayment of estimated tax by subtracting your expected liability from the total computed previously.

- Ensure that the calculated overpayment is at least 10% of the expected liability and a minimum of $500 to be eligible for a quick refund.

- In the declaration section, sign the form, indicating your title and date. If applicable, include the signature of the preparer, their address, and telephone number.

- After completing all sections, review your entries carefully for accuracy before saving your changes, downloading, printing, or sharing the form as necessary.

Complete your WI 4466W application online today for a prompt refund process.

Related links form

Only certain services sold, performed, or furnished in Wisconsin are subject to Wisconsin sales or use tax. Taxable services include: Admission and access privileges to amusement, athletic, entertainment, or recreational places or events. Access or use of amusement devices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.