Loading

Get Mo 1746 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 1746 online

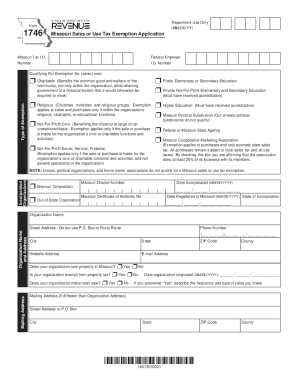

The MO 1746 form, also known as the Missouri Sales or Use Tax Exemption Application, is essential for organizations seeking tax exemption in Missouri. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently, ensuring a smooth application process.

Follow the steps to complete your application with ease.

- Click ‘Get Form’ button to retrieve the form and open it in the online editor.

- Fill out the Missouri Tax I.D. Number field if your organization has received one. This ensures the Department registers your organization correctly.

- Indicate the qualifying exemption type by selecting one of the options provided, such as 'Charitable,' 'Religious,' or 'Higher Education.' Ensure you understand the criteria for each exemption type.

- Complete the incorporated organization information by selecting whether you are a 'Missouri Corporation' or an 'Out-of-State Corporation.' Provide the required incorporation details, including the state of incorporation and registration dates.

- Provide the organization name and address accurately, ensuring it does not include a P.O. Box or rural route, to avoid any complications with mail delivery.

- Fill in the mailing address if it is different from the organization's address. You may use a P.O. Box for mailing purposes if needed.

- Enter details regarding the frequency and type of sales your organization makes if applicable. This helps clarify your organization’s activities.

- Summarize the primary purpose of your organization and its main activities in one or two brief statements. Detail how the exemption will be utilized.

- Ensure all necessary supporting documents are attached. This includes the IRS determination letter, certificate of incorporation, bylaws, and financial statements or projections if your organization is new.

- Review all entries for accuracy. After verifying, save your changes and download or print the completed form as needed.

- Submit the form via the provided mailing address or contact method if you need to clarify any aspects or submit electronically.

Start filling out your MO 1746 form online today to ensure your application for tax exemption is processed smoothly.

You'll need to complete an application to get a tax ID number, following the same formula regardless of which method you choose. In this formula, you'll provide some personal details, submit the form, then wait to receive your tax ID number. The online application is the best option for nearly all entrepreneurs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.