Loading

Get Aarp Tax-aide Expense Statement Volunteer Id - Assets - Aarp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AARP TAX-AIDE EXPENSE STATEMENT VOLUNTEER ID - Assets - AARP online

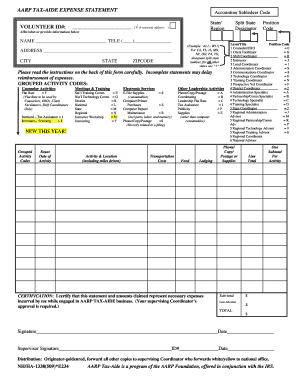

Filling out the AARP TAX-AIDE EXPENSE STATEMENT VOLUNTEER ID - Assets - AARP form is crucial for ensuring you receive reimbursement for your expenses incurred while assisting the AARP TAX-AIDE program. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your expense statement online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your volunteer ID# in the designated field at the top of the form. If you do not have a label, provide your name, address, and telephone number in the provided spaces.

- If applicable, check the box for a seasonal address.

- Fill in the accounting subledger code, noting your state and any split state designators required for specific regions.

- Enter your position code corresponding to your role within the AARP TAX-AIDE program, based on the highest position you hold.

- Complete the activity codes by entering the appropriate codes for each activity subtotal line, along with the exact dates, locations, and descriptions of each activity.

- Calculate transportation costs by multiplying the number of miles driven by the current mileage reimbursement rate, then enter this amount in the transportation costs field.

- Document any expenses related to food and lodging where required. Make sure to have receipts available for all non-mileage expenses.

- Add together all line totals for each activity and record the subtotal in the provided fields.

- Sign the statement certifying that the listed expenses are accurate and submit it to your supervising coordinator for their signature and ID#.

- After completing all steps, save changes, then download or print the form as needed. Forward copies, along with receipts, to your supervisor for processing.

Start filling out your AARP TAX-AIDE EXPENSE STATEMENT online now to ensure timely reimbursement!

Lease payments tend to be lower than a monthly loan payment would be with the same vehicle. Leasing also usually requires little to no money down, so if you don't have a lot saved for a down payment, leasing can be a good choice. The downside to leasing a BMW is the mileage restrictions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.