Loading

Get Irs 13715 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 13715 online

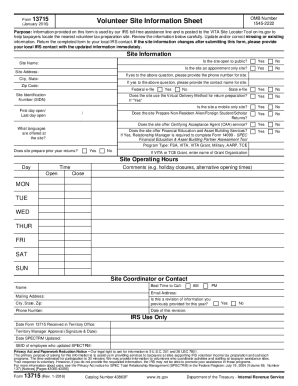

Filling out the IRS Form 13715 online is a straightforward process designed to gather essential site information for volunteer tax preparation services. This guide provides detailed, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the IRS 13715 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Begin by entering the site name in the designated field. This should be the official name of the volunteer site providing tax assistance.

- Input the site address. Make sure to provide the complete street address to ensure effective communication.

- Fill in the city, state, and zip code fields for the site location. Accuracy is crucial for users seeking assistance.

- Enter the Site Identification Number (SIDN) if available. If not, this can be left blank.

- Specify the first and last days the site will be open for service to assist taxpayers.

- List the languages offered at the site to accommodate diverse individuals.

- Indicate whether the site prepares prior year returns by selecting 'Yes' or 'No'.

- State if the site is open to the public. This helps users understand accessibility at the site.

- If the site operates by appointment only, provide the phone number and contact name for scheduling.

- Select whether the site offers federal and state e-filing services by choosing 'Yes' or 'No'.

- Indicate if the site uses the Virtual Delivery Method for return preparation.

- Confirm if it is a mobile only site to clarify the nature of service provided.

- Note if the site prepares returns for non-resident aliens, foreign students, or scholars.

- Specify if the site offers Certifying Acceptance Agent (CAA) services.

- Indicate whether the site provides financial education and asset building services.

- Enter the program type, such as VITA, TCE, or other grants, if applicable.

- Detail the site operating hours, including opening and closing times for each day.

- Provide the site coordinator or contact person's name, mailing address, phone number, and email address.

- Clarify if this is a revision of previously submitted information for the current year.

- Record the date of this revision if applicable.

- Finally, save changes, download, print, or share the completed form to ensure all information is documented.

Start completing the IRS 13715 online today to help taxpayers access the services they need.

All VITA/TCE volunteers must pass the VSC certification with a score of 80% or higher. All new and returning volunteer instructors, preparers, coordinators, and quality reviewers must take Publi- cation 5101, Intake/Interview and Quality Review Training and pass Intake/Interview and Quality Review certification.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.