Loading

Get Irs 8919 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8919 online

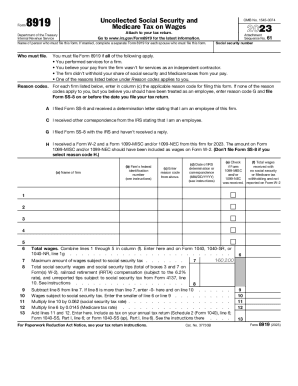

Filling out the IRS Form 8919 is essential for those who believe they were misclassified as independent contractors rather than employees. This guide provides a step-by-step process for completing the form accurately online, ensuring you report your uncollected social security and Medicare tax liabilities appropriately.

Follow the steps to fill out the form with confidence.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your personal information, including your name and social security number at the top of the form.

- Identify the firm for which you performed services by entering its name in column (a) and its federal identification number in column (b). If you are unsure of the firm’s federal identification number, enter 'unknown.'

- In column (c), select the reason code that applies to your situation, referring to the provided list of reason codes. Enter only one reason code per line.

- If reason code A or C is selected, fill in the corresponding date of IRS determination or correspondence in column (d).

- For lines 1 through 5, provide separate entries for each firm where applicable. If you worked for more than five firms, attach additional Forms 8919 as needed.

- Calculate the total wages from lines 1 through 5 and combine them in column (f), then enter this total in the designated space.

- Complete lines 7 through 13 based on the provided instructions to calculate your total social security and Medicare taxes owed.

- Review all entries for accuracy before finalizing your form.

- Once completed, you can save changes, download, print, or share the form as needed.

Begin the process of filing your IRS 8919 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. By filing this form, your social security earnings will be credited to your social security record.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.