Loading

Get Notice 96-45 - Weighted Average Interest Rate Update. Weighted Average Interest Rate Update

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice 96-45 - Weighted Average Interest Rate Update online

Filling out the Notice 96-45 is essential for determining the weighted average interest rate applicable to various plans. This guide will assist you in completing the Weighted Average Interest Rate Update accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the Notice 96-45 form and ensure it opens in your editor for further completion.

- Begin by reviewing the introductory section of the form, which includes important guidelines and context regarding the weighted average interest rates and permissible ranges.

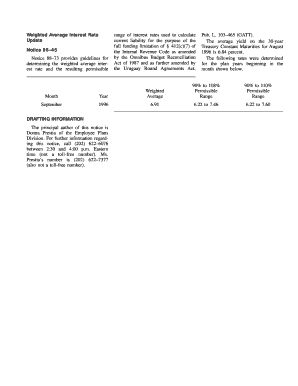

- Locate the section that specifies the month and year for which the weighted average interest rate applies. Ensure that you accurately fill in this information according to the relevant reporting period.

- Proceed to the field labeled 'Weighted Average' and enter the calculated rate that corresponds to the specified period. Ensure that you adhere to the proper decimal format to prevent errors.

- Refer to the permissible range sections that detail acceptable rates. Confirm that your entered weighted average rate adheres to the guidelines outlined in Notice 88-73 pertinent to full funding limitations.

- After filling out all necessary sections, review the entire form for accuracy. Double-check all entries and ensure compliance with the established regulations.

- Once you are satisfied with the completed form, you can save your changes, download the document for your records, print a physical copy if needed, or share it with relevant parties as required.

Complete your Notice 96-45 online today for timely and accurate submissions.

Lump Sum Value Is Based on Payout Date Then, at $462 a month and $5,544 annually, you need to reach 8.65 years to have the pension payments break even with a $48,000 lump sum payment. “In this simplified scenario, when the retiree's life expectancy is less than 8.65 years, the lump sum would be preferred,” Bryan M.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.