Loading

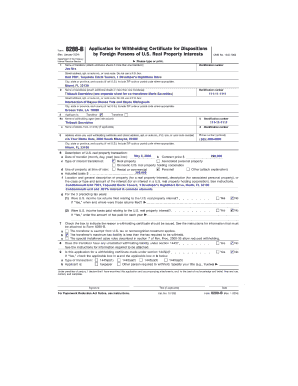

Get Attachment To Form 8288-b, Application For Withholding - Alta

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Attachment to Form 8288-B, Application for Withholding - Alta online

Filling out the Attachment to Form 8288-B is an essential step for those involved in the transfer of real property where withholding may be applicable. This guide provides a clear and supportive approach to completing the form online, ensuring users can navigate through the necessary sections confidently.

Follow the steps to complete the Attachment to Form 8288-B efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter the name of the transferor. In this case, fill in 'Joe Nra' as the transferor's name.

- Provide the Individual Taxpayer Identification Number (ITIN) in the designated field, ensuring it is accurate.

- Input the address of the property being transferred, which is 'Condo Unit 7601, Tequesta Circle Towers, Miami, FL 33130'.

- Calculate and enter 'The amount realized by the transferor on the transfer', which is $290,000 in this example.

- Document the adjusted basis of the property in the hands of the transferor. For example, enter $200,000.

- Indicate the details regarding amounts subject to recapture, if applicable. In this case, it is indicated as 'None'.

- State the maximum capital gains rate that applies to the transfer, which is 15% in this example.

- Calculate the tentative tax owed by the transferor, entering $10,890 as shown in the calculations.

- Complete the section on prior withholding liability, affirming that the transferor has no unsatisfied prior withholding tax liability related to this property.

- Once all fields are compiled accurately, save changes, download the completed form, and print or share as needed.

Complete your documents online today to ensure smooth processing!

FIRPTA applies to foreign corporations, partnerships and other entities selling U.S. real properties. It also applies to individual sellers who are considered non-residents. ... The amount of any liability assumed by the transferee or to which the property is subject immediately before and after the transfer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.