Loading

Get Revenue Procedure 2000-4 - Rulings And Information Letters; Issuance Procedures.. Revised

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Revenue Procedure 2000-4 - Rulings And Information Letters; Issuance Procedures online

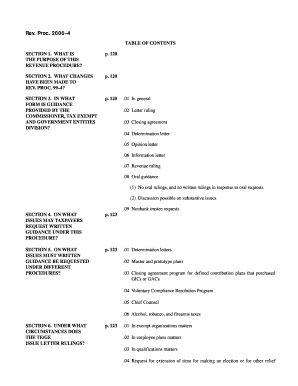

This guide is designed to assist users in properly completing the Revenue Procedure 2000-4 regarding rulings and information letters issued by the Internal Revenue Service. Follow these clear instructions to ensure your submission is accurate and aligns with the requirements.

Follow the steps to successfully complete the form.

- Press ‘Get Form’ button to access the form and open it in an editor for completion.

- Provide your taxpayer information, including name, address, and identification number. This essential information should reflect your current status and be easily verifiable.

- Include a detailed statement of facts related to your request. Make sure to describe the transaction and its business reasons comprehensively.

- Request the specific ruling sought. Clearly articulate what guidance you require from the IRS regarding your situation.

- Provide a statement of law that supports your views, including any pertinent regulations or authorities relevant to your case.

- Attach true copies of all relevant documents, ensuring they are labeled and submitted in alphabetical order for clarity.

- Include any additional required statements, such as those regarding prior returns or similar issues. Transparency about your previous filings is crucial.

- Complete a penalties of perjury statement confirming the facts in your submission are accurate and correct.

- Submit the completed form, along with necessary user fees, to the designated IRS office. Check twice that all components are included and correctly addressed.

- Once submitted, monitor the status of your request by contacting the appropriate IRS office, keeping records of your inquiries.

Start filling out the Revenue Procedure 2000-4 form online now to ensure your request is processed efficiently.

October 2023 Update – The IRS has resumed sending CP501, CP503, and CP504 collection notices in limited circumstances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.