Loading

Get Download Nj 2450 Form 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Download Nj 2450 Form 2014 online

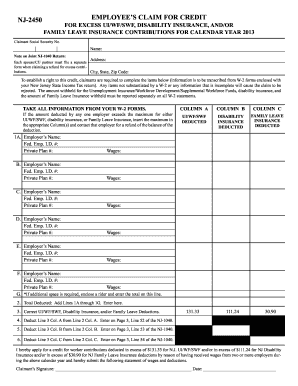

Filling out the Download Nj 2450 Form 2014 is a crucial step for individuals seeking a credit for excess contributions made towards unemployment insurance, disability insurance, and family leave insurance in New Jersey. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form accurately and submit it online.

- Press the ‘Get Form’ button to access the Download Nj 2450 Form 2014 and open it for editing.

- Begin by providing your personal information, including your social security number, name, and address. Ensure all details match the information on your W-2 forms.

- For each employer listed, fill out the required fields such as the employer's name, federal employer identification number, and private plan number. This information is critical for a successful claim.

- Report the amounts deducted for unemployment insurance/workforce development/supplemental workforce fund, disability insurance, and family leave insurance for each employer in the appropriate columns.

- If you had wages from more than one employer, make sure to enter the maximum deduction amount if any single employer withheld more than the allowable limit.

- Add together the amounts from lines 1A through 1G to get the total contributions you have reported. Enter this total in the designated field.

- Complete any necessary calculations to determine the corrections needed for your deductions and fill out lines 4, 5, and 6 appropriately.

- Review all entries for accuracy, ensure you have included any additional information, and attach additional documentation if required.

- Finally, save your completed form, download it, print it, or share it as needed to accompany your NJ-1040 return.

Complete your documents online to expedite your claim process.

Individuals To get a copy or transcript of your tax return, complete Form DCC-1 and send it to: ... You also can get a copy of your NJ-1040, NJ-1040NR or NJ-1041 at a Division of Taxation Regional Information Center. ... Otherwise, you can get a copy of a previously filed tax return by completing Form DCC-1 and sending it to:

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.