Loading

Get Revenue Procedure 2005-28 - Switching From The Fair Market Value Method To The Alternative Tax Book

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Revenue Procedure 2005-28 - Switching From The Fair Market Value Method To The Alternative Tax Book online

This guide provides a clear and user-friendly approach to filling out Revenue Procedure 2005-28, which facilitates the transition from the fair market value method to the alternative tax book value method for asset valuation. Follow these detailed steps to ensure a smooth and efficient process when completing the form online.

Follow the steps to successfully complete the Revenue Procedure 2005-28 form.

- Click the ‘Get Form’ button to access the Revenue Procedure 2005-28 form and open it in your preferred document editor.

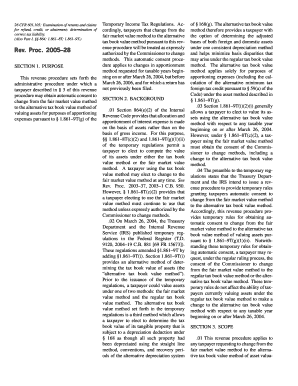

- Review the purpose of the form outlined in Section 1. Ensure that you qualify for automatic consent to switch methods of asset valuation as specified.

- Proceed to Section 4 to understand the application requirements. If applicable, gather necessary documentation to support your request for changing to the alternative tax book value method.

- Complete the form by selecting the appropriate asset valuation method in Part II of Schedule H on Form 1118 if you are a corporation. Ensure you attach a statement indicating your previous valuation method.

- If you are not a corporation, fill out Form 1116 and attach the required statement with the same details as above, noting the change in your asset valuation method.

- Check that all necessary documentation is included before submitting. For e-filing, ensure statements are properly entered into the Election Explanation Record of your submission.

- After filling out all required sections and verifying the accuracy of your information, save your changes, and choose to download, print, or share the completed form as needed.

Complete your document online now to streamline your transition to the alternative tax book value method.

If you don't file a tax return that you were supposed to, the IRS can file a return for you, called a substitute for return (SFR). The IRS prepares the return based on information it has from your employers, banks, and other payers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.