Loading

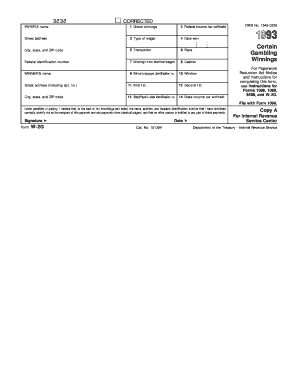

Get 1993 Form W-2g

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1993 Form W-2G online

Filling out the 1993 Form W-2G online can seem daunting, but understanding its components can make the process straightforward. This guide will help users navigate each section of the form confidently and accurately.

Follow the steps to complete the 1993 Form W-2G online seamlessly.

- Click the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- In the first section, input the payer's name, address, and federal identification number accurately. This information identifies the source of the gambling winnings.

- Enter the winner's name, address (including apartment number), and taxpayer identification number in the designated fields. This ensures proper identification for tax purposes.

- Fill in the gross winnings amount in Box 1. This is the total amount of winnings received and is crucial for tax reporting.

- Indicate the federal income tax withheld in Box 2, if applicable. This reflects the tax taken from your winnings based on the gambling activity.

- Specify the type of wager in Box 3. Provide details about the nature of the gambling winnings.

- Record the date the winnings were won in Box 4. Date accuracy is essential for your financial records.

- Complete Boxes 5 to 8 by providing relevant transaction information, race details (if applicable), winnings from identical wagers, and cashier details.

- In boxes 9 to 12, fill in the winner's identification numbers, including any additional identification required.

- Finally, review the form for accuracy, then save your changes, print the form, or share it as needed.

Begin completing your documents online for a hassle-free experience.

If the gaming facility does withhold taxes, it normally does so at the rate of 25 percent. If you don't provide your Social Security number, the withholding will be at 28% and start at lower payment amounts. You should receive all of your W-2Gs by January 31st of each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.