Loading

Get Charitable Gift Transfer - Charles Schwab Client Center

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Charitable Gift Transfer - Charles Schwab Client Center online

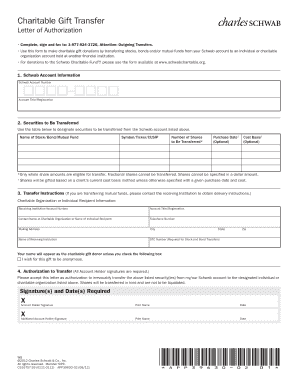

The Charitable Gift Transfer form allows users to donate securities from their Schwab account to charitable organizations or individuals. This guide details the steps necessary to complete the form online, ensuring a smooth and accurate submission process.

Follow the steps to successfully complete the Charitable Gift Transfer form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Schwab Account Information' section, enter your Schwab account number and the title or registration associated with the account.

- Proceed to the 'Securities to Be Transferred' section. Use the provided table to list the names of the stocks, bonds, or mutual funds you wish to donate. Include their corresponding symbols or CUSIPs and the number of whole shares to be transferred. Note that only whole shares can be donated; fractional shares are not eligible.

- In the same section, you may optionally provide the purchase date and cost basis for each security. If you do not specify these, the transfer will be made based on your account’s current cost basis method.

- Next, fill in the 'Transfer Instructions' section. Enter information for the charitable organization or individual recipient, including their account number, registration title, contact name, and their telephone number.

- Provide the mailing address, city, state, and zip code for the recipient. Indicate the name of the receiving institution and include the DTC number if you are transferring stocks or bonds.

- If you prefer that your name be kept anonymous as the charitable gift donor, check the appropriate box.

- In the 'Authorization to Transfer' section, confirm the irrevocable transfer by signing and dating the form. Ensure all account holders provide their signatures along with their printed names and the corresponding dates.

- After completing the form, save your changes, and choose to download or print it for submission. Make sure to fax the completed form to the specified number: 1-877-824-3726, Attention: Outgoing Transfers.

Complete your Charitable Gift Transfer form online today to support your chosen charities.

Section 1035 of the Internal Revenue Service code allows for the tax-free exchange of one annuity contract for another. Before initiating exchange of an existing annuity, there are a number of important factors to consider which could reduce or eliminate the benefit of the exchange.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.