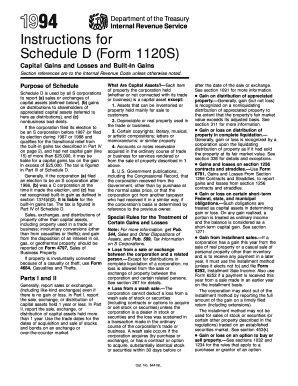

Get Department Of The Treasury Internal Revenue Service Instructions For Schedule D (form 1120s)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Department Of The Treasury Internal Revenue Service Instructions For Schedule D (Form 1120S) online

Filling out the Department Of The Treasury Internal Revenue Service Instructions For Schedule D (Form 1120S) online can seem daunting, but with a clear understanding of the process, it can be manageable. This guide provides straightforward steps to assist users in accurately completing the form for capital gains and losses related to S corporations.

Follow the steps to fill out the Schedule D (Form 1120S) online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by identifying the relevant sections of the form. Schedule D consists of multiple parts, including Part I for short-term capital gains and losses, and Part II for long-term capital gains and losses. Carefully read the instructions for both parts to ensure you understand what information is needed.

- In Part I, report sales or exchanges of capital assets held for one year or less. Include all relevant transactions, even if there is no gain or loss. Use the appropriate trade dates for any stocks or bonds.

- In Part II, report the sale, exchange, or distribution of capital assets held for more than one year. Again, ensure that you are using the correct trade dates.

- Move to Part III to determine if a capital gains tax applies. Answer the questions regarding net capital gain and taxable income to see if the corporation is liable for tax on capital gains exceeding $25,000.

- If applicable, complete Part IV relating to the built-in gains tax, following the specific instructions for reporting recognized built-in gains and losses.

- Review all entered information for accuracy and completeness. Make any necessary corrections before finalizing the form.

- Once completed, you can save your changes, download a copy of the form, print it, or share it as needed.

Complete your Schedule D (Form 1120S) online today to ensure accurate reporting of capital gains and losses.

Related links form

Because the ERC is considered an income-related grant under IAS 20, an entity may elect to present the income in one of two ways: (1) gross as a grant or other income item, or (2) net as a deduction from the expense category in which the reporting entity reports employment taxes (typically employee compensation).

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.