Loading

Get G 45 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G 45 Form online

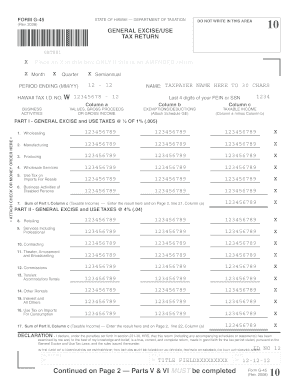

This guide provides step-by-step instructions on how to properly complete the G 45 Form online. It is designed to support users of all experience levels in navigating the required fields and sections effectively.

Follow the steps to complete the G 45 Form online.

- Press the ‘Get Form’ button to access the G 45 Form in the editor.

- Enter your Hawaii Tax I.D. number in the designated field. Ensure you provide accurate details as this is essential for processing your return.

- Fill in your business name, making sure it does not exceed 30 characters. This should reflect the legal entity under which you conduct business.

- Specify the period ending date in the MM/YY format. This indicates the tax period for which you are filing.

- In Part I, list the gross proceeds or gross income for each business activity you have engaged in. Remember to include the correct exemptions or deductions if applicable.

- Calculate your taxable income by subtracting the exemptions/deductions from the gross income for each activity. Enter the results in Column c.

- In Part III, document any insurance commissions received, ensuring to follow the rate specified.

- Finalize the form by reviewing all entries for accuracy. You can then save your changes, download, or print the form.

- Complete the declaration by signing and dating the form, ensuring the signature corresponds with the entity filing the return.

Take action now and complete your G 45 Form online today.

The periodic returns (Form G-45) are used to re- port gross income, exemptions, and taxes due on business activities periodically. ... The frequency you file depends on the amount of GET your business has to pay during the year. You must file monthly if you will pay more than $4,000 in GET per year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.