Loading

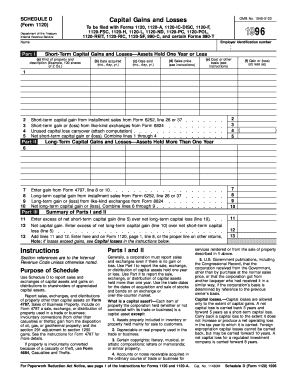

Get Schedule D (form 1120) Department Of The Treasury Internal Revenue Service Capital Gains And Losses

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SCHEDULE D (Form 1120) Department Of The Treasury Internal Revenue Service Capital Gains And Losses online

This guide provides step-by-step instructions for filling out SCHEDULE D (Form 1120) online. Designed for users of all experience levels, this guide ensures clarity and support throughout the process of reporting capital gains and losses.

Follow the steps to complete your SCHEDULE D online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I to report short-term capital gains and losses for assets held one year or less. In column (a), provide a description of the property. In column (b), enter the date the property was acquired. In column (c), input the date sold.

- Next, in column (d), indicate the sales price of the asset. In column (e), fill in the cost or other basis of the property.

- Calculate the gain or loss in column (f) by subtracting the amount in column (e) from column (d). Continue this for each asset listed.

- Proceed to summarize short-term gains and losses at the end of Part I. Combine the totals from each line to find the net short-term capital gain or loss.

- Move to Part II to report long-term capital gains and losses for assets held more than one year. Repeat the same process as in Part I, completing columns (a) through (f) for long-term assets.

- In Part III, summarize the results of Parts I and II. Enter the excess of net short-term capital gain over net long-term capital loss, followed by the net capital gain, and add these amounts accordingly.

- Finally, review all entries for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Start your SCHEDULE D online filing today!

Schedule D is an IRS form to help taxpayers compute their capital gains or losses and the taxes due. The calculations from Schedule D are combined with individual tax return Form 1040, which will affect the adjusted gross income amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.