Loading

Get Form 5884 Current Year Credit Omb No

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5884 Current Year Credit OMB No online

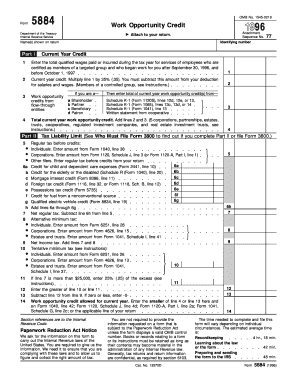

Filling out Form 5884 can help you claim the work opportunity credit for hiring targeted group employees. This guide provides clear, step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to fill out Form 5884 correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as shown on your return in the designated field at the top of the form.

- In Part I, line 1, input the total qualified wages paid or incurred during the tax year for employees certified as members of a targeted group who began work between September 30, 1996, and October 1, 1997. Ensure the amount reflects no more than $6,000 per employee.

- Complete line 2 by entering the total of current year work opportunity credits from flow-through entities if applicable. Use your Schedule K-1 (Form 1120S, Form 1065, or Form 1041) to find these amounts.

- Add the totals from lines 2 and 3 in line 4 to calculate the total current year work opportunity credit.

- Proceed to Part II if applicable. Enter your identifying number on line 4 as required.

- In line 5, provide the regular tax amount before any credits, referring to your tax return as necessary.

- Complete lines 6a to 6g by entering the amounts for any applicable credits such as child and dependent care, elderly or disabled credits, etc.

- Calculate your net regular tax by subtracting line 6h from line 5 on line 7.

- If applicable, enter amounts for alternative minimum tax on lines 8, followed by net income tax on line 9.

- Determine the tentative minimum tax for line 10 based on the required schedule.

- Finally, on line 14, enter the credit allowed for the current year. Make sure to check that this amount does not exceed your tax liability limit and save any relevant deductions.

- After completing the form, save your changes, download it for your records, print it for submission, or share it as needed.

Complete your Form 5884 online today to claim your work opportunity credit.

a Employee's social security number. OMB No. 1545-0008. This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.