Loading

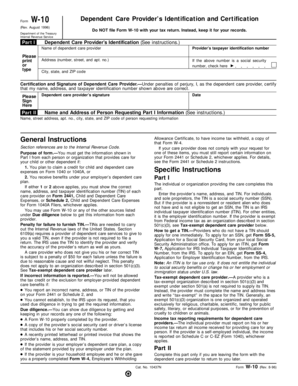

Get Dependent Care Provider S Identification (see Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dependent Care Provider’s Identification (See Instructions) online

Completing the Dependent Care Provider’s Identification form is essential for parents claiming tax credits for child and dependent care expenses. This guide provides detailed steps to ensure accurate and efficient completion of the form, helping you navigate the requirements with confidence.

Follow the steps to accurately complete the form

- Click ‘Get Form’ button to access the Dependent Care Provider’s Identification form and open it in your editor.

- In Part I, clearly print or type the dependent care provider’s name, followed by their taxpayer identification number. This number is crucial for compliance with tax regulations.

- Fill in the provider’s address, including the number, street, apartment number, city, state, and ZIP code. Ensure this information is accurate to avoid future complications.

- If the taxpayer identification number (TIN) provided is a social security number, check the corresponding box.

- In the certification section, the dependent care provider must sign and date the form, confirming the accuracy of the information provided.

- Complete Part II if you are leaving the form with the dependent care provider for them to return later. Include their name, address, and other requested information.

- After filling out the necessary sections, ensure to save your changes. You may then download, print, or share the completed form as needed.

Take action today to complete your forms online and ensure that you can take advantage of eligible tax credits.

More In Help. You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you (and your spouse, if filing a joint return) to work or actively look for work. Generally, you may not take this credit if your filing status is married filing separately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.