Loading

Get Np-20 (04-12).indd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NP-20 (04-12) online

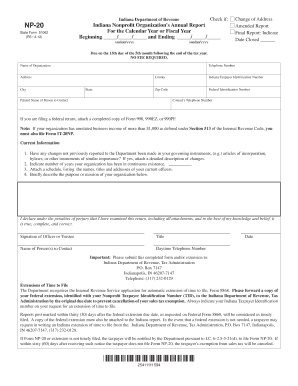

Filling out the NP-20 form online is an important step for Indiana nonprofit organizations to report their annual activities. This guide will assist you in completing the form accurately and efficiently.

Follow the steps to complete the NP-20 form online.

- Click ‘Get Form’ button to obtain the NP-20 form and open it in your chosen editor.

- Provide the organization’s name, telephone number, and address, including city, state, county, and zip code. Ensure all contact details are accurate.

- Enter the Indiana taxpayer identification number and federal identification number in the designated fields.

- Indicate the printed name of the person to contact and their telephone number for any follow-up inquiries.

- If applicable, check the box for change of address, amended report, or final report, and indicate the date closed.

- Complete the section on current information. Report any changes not previously disclosed, and if there are changes, attach a detailed description.

- Indicate the number of years your organization has been in continuous existence.

- Attach a schedule that lists the names, titles, and addresses of current officers.

- Provide a brief description of the purpose or mission of your organization.

- Enter the email address for communication regarding the form.

- Have the appropriate officer or trustee sign and date the form, verifying the information is true and complete.

- Review all sections for accuracy, then save changes. You can choose to download, print, or share the completed form as needed.

Complete your forms online for a streamlined experience.

You have the following options to pay your tax: Send e-payment through state website. Mail payment to: Indiana Department of Revenue. P.O. Box 6117. Indianapolis, IN 46206-6117.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.