Loading

Get 1997 Form 1120-s (schedule D)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

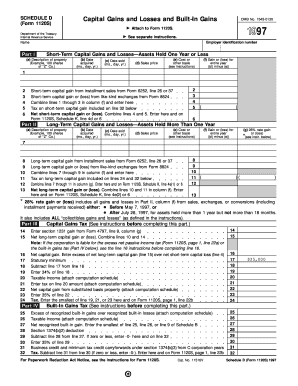

How to fill out the 1997 Form 1120-S (Schedule D) online

Filling out the 1997 Form 1120-S (Schedule D) online requires attention to detail to accurately report capital gains and losses from your business. This guide will walk you through each section to ensure you complete the form correctly and efficiently.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online application.

- Begin with Part I for short-term capital gains and losses. Enter the description of property in column (a), followed by the acquisition date in column (b) and the sale date in column (c). Fill in the sales price in column (d) and the cost or other basis in column (e), and calculate the gain or loss in column (f) by subtracting column (e) from column (d). Repeat for each asset.

- Add any short-term capital gains from installment sales using Form 6252, and any gains or losses from like-kind exchanges using Form 8824. Combine the totals in column (f) and enter the result on line 4.

- In Part II, repeat the process for long-term capital gains and losses, providing the necessary details for each asset in the corresponding columns.

- Calculate and report any long-term capital gains from installment sales and like-kind exchanges, summarizing the relevant totals and entering them as directed.

- Proceed to Part III to report capital gains tax by entering any section 1231 gains as outlined. Combine the necessary figures to determine taxable amounts.

- Complete Part IV regarding built-in gains tax by entering recognized gains and losses and following the instructions to calculate tax owed.

- Review all completed sections for accuracy. Once satisfied with your entries, you can save changes, download, print, or share the form for future reference.

Complete your documents efficiently by filling out forms online!

However, you must include on your Schedule D the totals from all Forms 8949 for both you and your spouse. Corporations and partnerships. Corporations and partnerships use Form 8949 to report the following. The sale or exchange of a capital asset not reported on another form or schedule.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.