Loading

Get 1545-0236 (rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1545-0236 (Rev online)

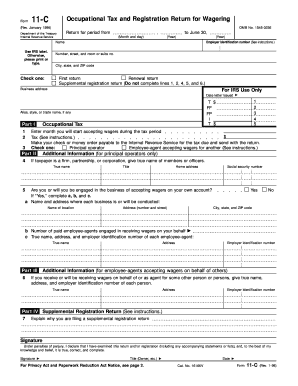

This guide provides a comprehensive overview of how to effectively fill out the 1545-0236 (Rev), also known as the Occupational Tax and Registration Return for Wagering. Following these steps will help you ensure that your form is completed accurately and filed in a timely manner.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the document. Ensure you open the form in a compatible editor for smooth completion.

- Fill out the return period by entering the relevant month and year you will start accepting wagers and the ending year. Make sure to follow the format required.

- In the 'Name' section, use the IRS label if available. Otherwise, print or type your name clearly. Provide your Employer Identification Number (EIN) in the designated box.

- Choose the appropriate checkbox indicating whether this is your first return, a renewal, or a supplemental registration return.

- Complete the business address section if it differs from your home address. Enter all necessary details such as street number, city, state, and ZIP code.

- For the occupational tax section, indicate the month you will commence accepting wagers and enter the calculated tax amount due based on when wagers are accepted.

- Select whether you are acting as a principal operator or an employee-agent accepting wagers for another party.

- If you are a principal operator, provide additional information regarding your firm, partnership, or corporation, including names of members or officers. Complete the relevant sections for location and employee details.

- If you are an employee-agent, provide the name, address, and EIN of your principal operator.

- Sign and date the form, ensuring your title (e.g., owner) is indicated. Under penalties of perjury, declare that the information is true and complete.

- After completing the form, save any changes, and prepare to download, print, or share your submission as needed.

Start completing your documents online today to ensure timely filing and compliance.

The primary purpose of filing Form 730 is to report and pay the federal excise tax on wagers. The tax is levied on the amount of wagers received by the business, and the form is used to calculate the tax liability for each month and remit the payment to the Internal Revenue Service (IRS).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.