Loading

Get Security Agreement (security Interest In Consumer Goods)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

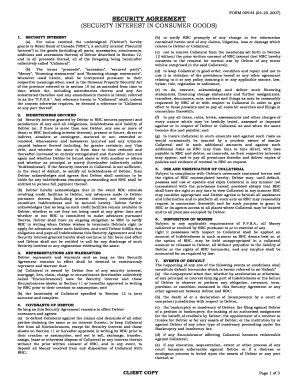

How to fill out the SECURITY AGREEMENT (SECURITY INTEREST IN CONSUMER GOODS) online

Filling out the SECURITY AGREEMENT (SECURITY INTEREST IN CONSUMER GOODS) form online is crucial for establishing a security interest in consumer goods. This guide will provide clear, step-by-step instructions to support you through the process.

Follow the steps to complete the form accurately and efficiently.

- Click 'Get Form' button to access the SECURITY AGREEMENT (SECURITY INTEREST IN CONSUMER GOODS) document and open it in your preferred online editor.

- In the first section, titled SECURITY INTEREST, provide the legal name of the Debtor and details of the goods being secured, as well as any related descriptions. Ensure to include all necessary parts and accessories.

- Move to the INDEBTEDNESS SECURED section. Here, indicate the nature of the obligations that are secured by this agreement, such as loans or credit. Clearly state whether the debts are present, future, or contingent.

- In the REPRESENTATIONS AND WARRANTIES section, confirm the Debtor’s ownership of the collateral. This includes stating that the collateral is free of any encumbrances except for the ones specified.

- Proceed to exhaustively complete the COVENANTS OF DEBTOR section. Here, you will outline the commitments of the Debtor, such as defending collateral against claims and ensuring the collateral is kept in good condition.

- In the USE AND VERIFICATION OF COLLATERAL section, specify the manner in which the collateral may be used, as well as acknowledge RBC's right to audit the collateral at any time.

- Complete the EVENTS OF DEFAULT section by detailing what constitutes a default under this agreement, ensuring that all conditions that can lead to default are clearly articulated.

- Enter into the MISCELLANEOUS section to disclose any additional agreements or authorizations specific to the security agreement, including how notices should be delivered.

- Fill in Sections 11 and 12 where you will provide details about any encumbrances affecting collateral and give a detailed description and location of the collateral being secured.

- Finally, ensure that all Debtor information, including names, addresses, and dates of birth, are correctly inserted in the designated section. Review for accuracy.

- After completing all required sections, save your changes. You can then download, print, or share the SECURITY AGREEMENT as needed.

Begin filling out your SECURITY AGREEMENT online today to secure your interests effectively.

The purchase-money security interest is perfected when the debtor receives possession of the inventory Note: Because there is no grace period and the lien must be perfected prior to the debtor receiving possession, the UCC-1 must be filed and the lien must attach (which means the secured party must have provided ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.