Loading

Get Form 8833

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8833 online

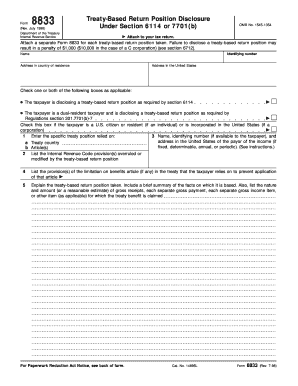

Filling out Form 8833 is an essential part of disclosing your treaty-based return position to the Internal Revenue Service. This guide provides detailed, step-by-step instructions to ensure you accurately complete the form online.

Follow the steps to successfully complete Form 8833.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Enter your name, identifying number, and address in your country of residence. This information should include your city, province or state, and country following the country's postal code format.

- Provide your address in the United States, if applicable.

- Select the applicable checkboxes to indicate if you are disclosing a treaty-based return position as required by section 6114 or claiming dual-resident taxpayer status as required by Regulations section 301.7701(b)-7.

- In line 1, specify the treaty position you are relying on. Include the specific treaty country and the relevant articles if applicable.

- List the Internal Revenue Code provisions that are overridden or modified by the treaty-based return position in line 2.

- Complete line 4 by listing any provision(s) of the limitation on benefits article in the treaty that you utilize.

- In line 5, explain your treaty-based return position in detail, including a summary of the pertinent facts, and provide estimates of gross receipts or payments for which you are claiming the treaty benefit.

- Review all entered information for accuracy.

- Once you have completed the form, save the changes made, and opt to download, print, or share the form as needed.

Start filling out your Form 8833 online today to ensure compliance with your tax obligations.

Form 8843 is a Statement for Exempt Individuals who use to show they are not counting their days within the US. Form 8833 is a form you file to claim tax treaty benefit. In your situation, you might not need the Form 8843.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.