Loading

Get Form 5712a (rev. September 1997). Election And Verification Of The Cost Sharing Or Profit Split

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 5712A (Rev. September 1997). Election And Verification Of The Cost Sharing Or Profit Split online

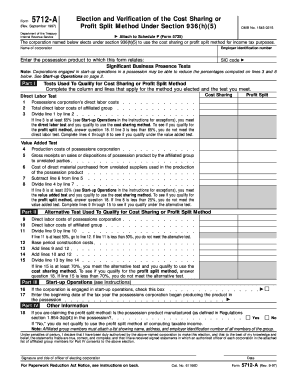

Filling out Form 5712A is an essential process for corporations seeking to elect the cost sharing or profit split method for tax purposes. This guide offers clear and detailed instructions on how to accurately complete the form online, ensuring compliance with IRS requirements.

Follow the steps to fill out Form 5712A correctly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the name of the corporation and the employer identification number in the designated fields at the top of the form.

- Specify the possession product related to this form by entering the relevant SIC code, which identifies the product area.

- In Part I, complete the tests used to qualify for the cost sharing or profit split method. For the Direct Labor Test, enter the direct labor costs of the possessions corporation and the total direct labor costs of the affiliated group.

- Calculate the percentage on line 3 by dividing line 1 by line 2. If the result is at least 65%, you qualify for the cost sharing method. If not, proceed to the Value Added Test.

- For the Value Added Test, provide the production costs and gross receipts on lines 4 and 5 respectively. Continue by subtracting the cost of direct materials from the gross receipts on line 7.

- Calculate the percentage on line 8 by dividing line 4 by line 7. A result of 25% or more qualifies you for the cost sharing method; otherwise, proceed to the alternative test.

- In Part II, fill in direct labor costs on lines 9 and 10, and determine if you meet the alternative test using the provided calculations on lines 11 through 15.

- If applicable, check the box regarding start-up operations in Part III, and enter the beginning date of the tax year when production began.

- In Part IV, if claiming the profit split method, answer the question regarding whether the possession product is manufactured in the possession; select Yes or No.

- Lastly, ensure the form is properly signed and dated by an authorized corporate officer before submission.

- Once all changes have been made, users can save changes, download, print, or share the form as needed.

Start completing your Form 5712A online to ensure your corporation's compliance and take advantage of available tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.