Loading

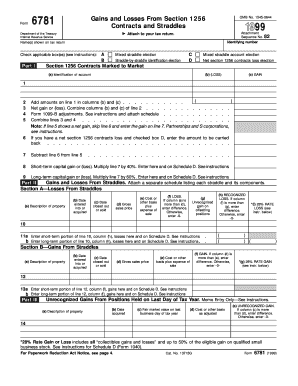

Get 1999 Form 6781. Gains And Losses From Section 1256 Contracts And Straddles

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1999 Form 6781. Gains And Losses From Section 1256 Contracts And Straddles online

Filling out the 1999 Form 6781 is essential for reporting gains and losses from Section 1256 contracts and straddles. This guide provides a step-by-step approach for users to complete the form accurately online, ensuring clarity and compliance with IRS requirements.

Follow the steps to effectively complete Form 6781.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred PDF viewer.

- Enter your identifying number and the names shown on your tax return in the designated fields at the top of the form.

- Check any applicable boxes regarding elections related to mixed straddles or net section 1256 contracts loss.

- In Part I, provide details of your Section 1256 contracts marked to market, including gains and losses for each contract you held at year-end or closed out during the year.

- Ensure to add amounts from line 1 in the designated columns to calculate your net gain or loss.

- For any Form 1099-B adjustments, follow the instructions to report these on line 4 accurately.

- If you have a loss and checked box D, enter the amount to be carried back to past tax years.

- Calculate your short-term and long-term capital gains or losses based on line 7, and enter these figures on Schedule D.

- In Part II, list any straddle positions, providing relevant information such as description, dates, sales price, cost basis, and any gains or losses.

- Consolidate the recognized losses and gains from straddles into short-term and long-term categories as appropriate.

- Complete Part III if applicable, listing unrecognized gains from positions held on the last day of the tax year.

- Finally, review your completed form for accuracy before saving your changes, downloading, or printing it for submission.

Complete your documents online confidently and ensure timely submission.

If your section 1256 contracts produce capital gain or loss, gains or losses on section 1256 contracts open at the end of the year, or terminated during the year, are treated as 60% long term and 40% short term, regardless of how long the contracts were held.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.