Loading

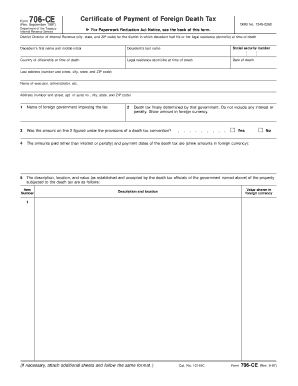

Get Form 706-ce (rev. September 1997). Certificate Of Payment Of Foreign Death Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 706-CE (Rev. September 1997). Certificate Of Payment Of Foreign Death Tax online

Filling out Form 706-CE is essential for claiming a credit for foreign death taxes on the U.S. estate tax return. This guide provides step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Fill in the district director's information, including the city, state, and ZIP code for the area where the decedent had their legal residence at the time of death.

- Enter the decedent’s first name, middle initial, and last name accurately.

- Provide the decedent's social security number and indicate their country of citizenship at the time of death.

- Document the decedent's legal residence (domicile) at the time of death and their date of death.

- Input the last address of the decedent, including the number and street, city, state, and ZIP code.

- Enter the name and address of the executor, administrator, or involved party, including the number and street, apartment or suite number, city, state, and ZIP code.

- List the name of the foreign government imposing the tax and indicate whether the amount was calculated under a death tax convention.

- Fill in the amount of the death tax finally determined by the foreign government, ensuring to show the amount in foreign currency. Exclude interest or penalties.

- Detail the amounts paid related to the death tax, providing payment dates and amounts in foreign currency.

- Describe the property subject to the death tax, including its location and value as acknowledged by the foreign tax officials.

- If any refund of the death tax has been claimed or allowed, provide details regarding the amount and status.

- Explain any pending credits against or reductions of the death tax, and if applicable, provide information regarding double taxation on property.

- Sign and date the certification section of the form, affirming the information is true and complete.

- Once all sections are accurately completed, save the changes, and download, print, or share the form as needed without further delays.

Start filling out your Form 706-CE online to ensure compliance with your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.