Loading

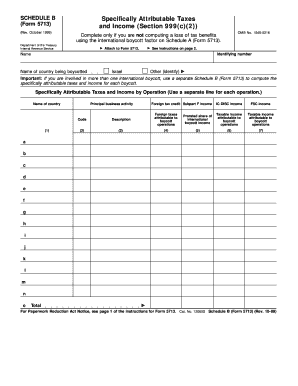

Get Form 5713 (schedule B) (rev. October 1999). Specifically Attributable Taxes And Income (section

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5713 (Schedule B) (Rev. October 1999). Specifically attributable taxes and income (Section online

This guide provides a clear, step-by-step approach to filling out Form 5713 (Schedule B) (Rev. October 1999), focusing on specifically attributable taxes and income. It is designed to assist users in accurately completing the form, ensuring compliance with tax regulations.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Enter the name of the country being boycotted in the appropriate field. If you are boycotting multiple countries, be sure to complete a separate Schedule B for each.

- In the principal business activity code section, input the code corresponding to your business activity related to the boycott operation.

- Briefly describe the principal business activity in the designated area, including any relevant product codes in parentheses if applicable.

- Report the foreign taxes attributable to the boycott operations in the foreign taxes field, ensuring to exclude any taxes that do not qualify for the foreign tax credit.

- Complete the section for prorated shares of income from controlled foreign corporations that are attributable to the boycott operations.

- Calculate and enter the taxable income attributable to the boycott operations in the designated column, making sure to follow the specified steps outlined in the instructions.

- Finally, review all entries for accuracy, save your changes, and then download, print, or share the completed form as necessary.

Complete your documents online today for a streamlined filing experience.

The willful failure to file Form 5713 can result in a $25,000 fine, imprisonment for no more than one year, or both.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.