Loading

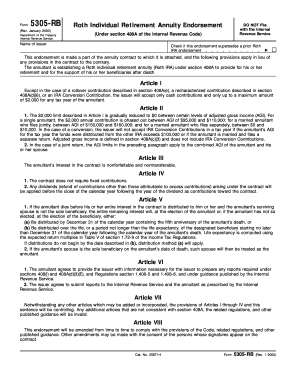

Get Form 5305-rb (rev. January 2000). Roth Individual Retirement Annuity Endorsement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5305-RB (Rev. January 2000). Roth Individual Retirement Annuity Endorsement online

Filling out Form 5305-RB is an important step in establishing a Roth individual retirement annuity, also known as a Roth IRA. This guide will provide you with detailed instructions to complete the form online, ensuring you understand each section and its requirements.

Follow the steps to fill out Form 5305-RB accurately and efficiently.

- Press the ‘Get Form’ button to access the form and open it within your online environment.

- Locate the 'Name of issuer' field and enter the name of the insurance company providing the annuity. This information is essential for correctly associating the annuity with the issuer.

- Check the box if this endorsement supersedes any prior Roth IRA endorsement. This step is important to clarify the validity of this new endorsement.

- Read through Articles I to VIII carefully, as they contain key provisions regarding contributions, limits, and distribution rules related to your Roth IRA. Make sure you understand these sections.

- In Article I, confirm the contribution limits and ensure you understand the impact of your adjusted gross income on contribution eligibility.

- If necessary, fill in Article IX with any additional provisions that may be relevant to your contract. This section allows for customization and must comply with applicable regulations.

- Once all fields are completed and you have reviewed the form for accuracy, save your changes and choose your preferred method to download, print, or share the completed form.

Start filling out your documents online for a smoother and more efficient process.

Roth IRAs hold a lot of appeal, thanks to their tax-advantaged status. Annuities, meanwhile, can provide you with reliable income for retirement. Combining both into a Roth IRA annuity is something you might consider if you'd like to enjoy the best of both worlds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.