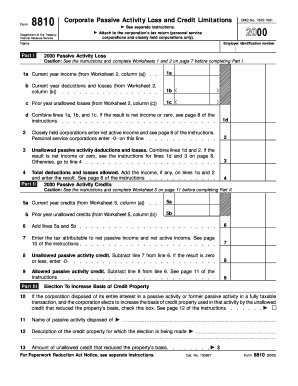

Get 1545-1091 Department Of The Treasury Internal Revenue Service 2000 Employer Identification Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:The times of terrifying complex legal and tax documents are over. With US Legal Forms the entire process of creating official documents is anxiety-free. The leading editor is directly at your fingertips offering you a range of beneficial tools for completing a 1545-1091 Department Of The Treasury Internal Revenue Service 2000 Employer Identification Number. These tips, together with the editor will guide you with the entire process.

- Hit the orange Get Form option to start editing.

- Activate the Wizard mode on the top toolbar to get more tips.

- Fill out every fillable area.

- Make sure the information you fill in 1545-1091 Department Of The Treasury Internal Revenue Service 2000 Employer Identification Number is up-to-date and accurate.

- Include the date to the record with the Date function.

- Click the Sign tool and make a digital signature. You will find 3 available alternatives; typing, drawing, or capturing one.

- Check each and every area has been filled in properly.

- Select Done in the top right corne to export the sample. There are various options for getting the doc. As an instant download, an attachment in an email or through the mail as a hard copy.

We make completing any 1545-1091 Department Of The Treasury Internal Revenue Service 2000 Employer Identification Number faster. Use it now!

Related links form

The EIN is information within the public domain, so you can legally search for the number for any company, but it is a federal crime to use the information illegally. Looking up an EIN isn't always easy, particularly for smaller businesses, but there are a number of methods, including by phone and searching online.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.