Loading

Get 2015 Ic-046 Form 4h Wisconsin Corporation Declaration Of Inactivity - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 IC-046 Form 4H Wisconsin Corporation Declaration Of Inactivity - Revenue Wi online

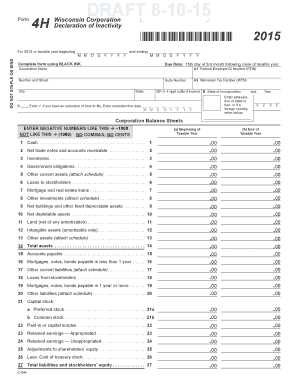

Filing the 2015 IC-046 Form 4H is essential for Wisconsin corporations that have been completely inactive during their taxable year. This guide provides clear, detailed instructions to help users fill out this form online effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter the taxable year at the top of the form, specifying the beginning and ending dates accurately in the designated fields.

- Indicate if an extension of time to file has been granted by checking the corresponding box and entering the new due date if applicable.

- Include the contact person’s name and telephone number for any inquiries regarding this return.

- Once satisfied, users can save the changes, download, print, or share the completed form as necessary.

Complete your forms online with confidence and ensure timely submissions.

Depending on IRS security procedures, the tax refund date could take up to 21 days after the IRS tax return acceptance date or as early as 7 days via the bank direct deposit method. Certain tax credits may delay the issuing of your refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.