Loading

Get Form 8697 (rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8697 (Rev online

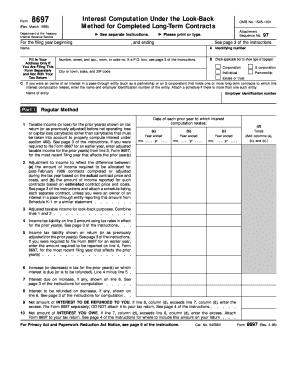

Form 8697 is utilized for the interest computation under the look-back method for completed long-term contracts. This guide provides a detailed overview and step-by-step instructions to assist users in successfully filling out the form online.

Follow the steps to complete the Form 8697 (Rev) effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the required information for the filing year beginning and ending dates at the top of the form. Ensure to input the accurate dates as this will determine the tax year relevant to your computations.

- Enter your name and identifying number as asked in the designated fields. If you are filing this form separately and not with your tax return, fill in your address details.

- Check the applicable box to indicate your type of taxpayer, which can be a corporation, S corporation, individual, partnership, or estate or trust. This information will help in processing your form accurately.

- If applicable, provide the name and employer identification number of any pass-through entity in which you have an interest related to this interest computation.

- In Part I, begin with line 1 by entering the taxable income or loss from the prior year(s) before net operating loss or capital loss carrybacks. Ensure to reference the relevant tax return for accurate figures.

- Continue with line 2, providing adjustments to income that reflect differences in contract pricing and costs. Attach a schedule listing each contract if necessary.

- Compute adjusted taxable income for look-back purposes on line 3 by combining line 1 and line 2.

- Complete lines 4 through 10 by calculating the relevant tax liabilities and determining any increase or decrease in tax for the prior year(s) on which interest is due or refundable.

- Finally, review your entries for accuracy before saving changes. You can download, print, or share the completed form as needed.

Complete your Form 8697 (Rev) online for a smoother filing experience.

The Failure to Pay Penalty is calculated the following way: The Failure to Pay Penalty is 0.5% of the unpaid taxes for each month or part of a month the tax balance remains unpaid. The penalty won't exceed 25% of the taxpayer's unpaid taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.