Loading

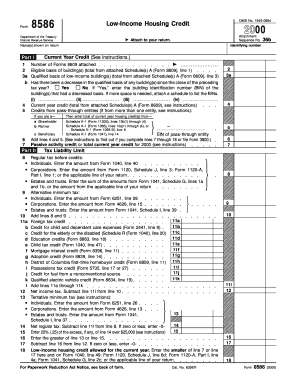

Get 1545-0984 Department Of The Treasury Internal Revenue Service Attachment Sequence No

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1545-0984 Department Of The Treasury Internal Revenue Service Attachment Sequence No online

Filling out the 1545-0984 form, commonly known as the Low-Income Housing Credit form, is an important process for property owners involved in low-income housing projects. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete the form online.

- Click 'Get Form' button to obtain the form and open it in your chosen online platform.

- Fill in your name(s) as shown on your income tax return in the designated field at the top of the form.

- In Part I, input the current year credit amount based on your calculations or instructions provided.

- Indicate the number of Forms 8609 you are attaching by entering this number where prompted.

- Enter the eligible basis of your building(s), which totals the amounts from the attached Schedule A (Form 8609), line 1.

- Report the qualified basis of low-income building(s) using the data from attached Schedule A (Form 8609), line 3.

- Address whether there has been a decrease in the qualified basis of any building(s) by choosing 'Yes' or 'No'. If applicable, list the building identification numbers associated with any decreases.

- Calculate and record the current year credit, using the total from attached Schedule A (Form 8609) as directed.

- If applicable, enter credits from any pass-through entities, providing the necessary details as instructed.

- Complete Part II only if needed, following instructions for any additional calculations regarding tax liabilities.

- Once all fields are completed and reviewed, you can proceed to save changes, download, print, or share the completed form as necessary.

Prepare your documents online today to ensure a smooth filing experience.

If you are filing a paper return, include one copy of each of your information slips. These slips show the amount of income that was paid to you during the year and the deductions that were withheld from that income. Notes on each slip tell you where to report the income on your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.