Loading

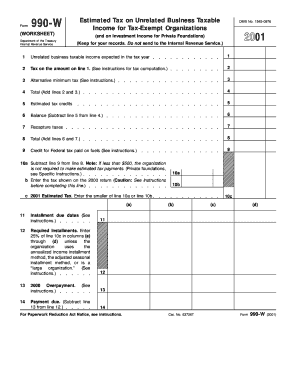

Get 1545-0976 (worksheet) Department Of The Treasury Internal Revenue Service 2001 1 2 3 4 5 6 7 8 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1545-0976 (WORKSHEET) Department Of The Treasury Internal Revenue Service 2001 online

Filling out the 1545-0976 (WORKSHEET) for estimated tax on unrelated business taxable income can be straightforward with the right guidance. This comprehensive guide will help users navigate each section of the form with clarity and confidence.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with line 1 where you will enter the expected unrelated business taxable income for the tax year. Ensure that this amount is based on realistic projections to avoid penalties later.

- Move to line 2 and calculate the tax on the amount from line 1. Refer to the instructions provided to complete this calculation accurately.

- On line 3, determine if any alternative minimum tax applies and enter that information.

- For line 4, add the amounts from lines 2 and 3 to get the total tax liability.

- On line 5, list any estimated tax credits that may apply. This can help reduce the total tax you need to pay.

- Calculate the balance on line 6 by subtracting line 5 from line 4.

- Enter any recapture taxes on line 7 if applicable, and then sum line 6 and line 7 to complete line 8.

- Line 9 is for the credit for Federal tax paid on fuels, if applicable. Make sure to read the related instructions.

- Lines 10a through 10c involve subtracting line 9 from line 8 and entering the smallest amount between line 10a or the tax shown on your last return.

- Input necessary payment installment due dates on line 11, making sure to list them correctly as specified.

- After completing the form, ensure all information is entered correctly and save your changes.

- Finally, you may print, share, or download the form for your records.

Start filling out your 1545-0976 (WORKSHEET) online now to ensure accurate tax estimates for your organization.

The worksheets TurboTax prepares are not Efiled. You could Download your return with all worksheets for the most complete copy of your return, then choose to actually Print only what you need. Click this link for more info on Printing My Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.