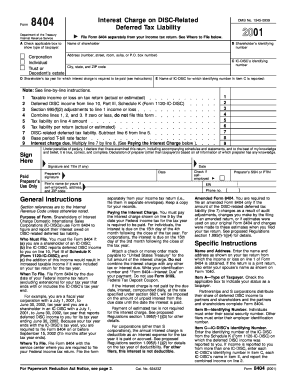

Get 2001 Form 8404, (fill-in Version). Interest Charge On Disc-related Deferred Tax Liability

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2001 Form 8404, (Fill-in Version). Interest Charge On DISC-Related Deferred Tax Liability online

This guide provides a step-by-step approach to completing the 2001 Form 8404, designed for individuals who need to report interest charges related to DISC-related deferred tax liabilities. Whether you are a shareholder or a partner, this guide will help you navigate the form efficiently.

Follow the steps to complete Form 8404 accurately.

- Use the ‘Get Form’ button to obtain the form and open it for editing.

- Fill in the type of taxpayer in Section A by checking the applicable box (Corporation, Individual, Trust, or Decedent’s estate). Make sure to provide your name and address as listed on your tax return.

- Enter your shareholder's identifying number in Section B. Individuals will input their social security number while corporations and other entities enter their employer identification number.

- Input the IC-DISC’s identifying number in Section C, as reported on Schedule K (Form 1120-IC-DISC). If there are multiple IC-DISCs, include each one in this section.

- In Section D, indicate the shareholder's tax year for which the interest charge applies, using the appropriate dates.

- Complete Section E by entering the IC-DISC’s name corresponding to the identifying number you've listed in Section C.

- Proceed to the numbered lines 1 through 9, starting with line 1, where you will enter your taxable income or loss as reported on your Federal income tax return for the appropriate tax year.

- Follow through lines 2 to 9: calculate deferred DISC income, tax liabilities and finally derive the interest charge due. Ensure each calculation follows the guidelines provided in the form for accuracy.

- Once complete, sign the form in the designated area and ensure any preparer or firm information is filled out if applicable.

- Save any changes made to the form, and then download or print a copy for your records. Ensure you file this form separately from your income tax return.

Complete your Form 8404 online today to ensure accurate reporting of your interest charge.

The Interest Charge Domestic International Sales Corporation (IC-DISC) offers significant Federal income tax savings for making or distributing US products for export. The IC-DISC was originally created by Congress to promote export sales by allowing companies to defer income, with interest charged on the deferred tax. IC-DISC | Exporter Tax Incentives - KBKG kbkg.com https://.kbkg.com › ic-disc kbkg.com https://.kbkg.com › ic-disc

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.