Loading

Get 2001 Form 1040-es (fill-in Version). Estimated Tax For Individuals

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2001 Form 1040-ES (Fill-in Version). Estimated Tax For Individuals online

Filing your estimated tax can seem challenging, but with the right guidance, it can be a straightforward process. This guide will help you navigate the 2001 Form 1040-ES (Fill-in Version) to accurately calculate and pay your estimated tax obligations.

Follow the steps to complete your estimated tax form accurately.

- Click ‘Get Form’ button to obtain the 2001 Form 1040-ES and open it in the editor.

- Fill out your personal information at the top of the form, including your full name, address, and Social Security number. If filing jointly, include your partner's information as well.

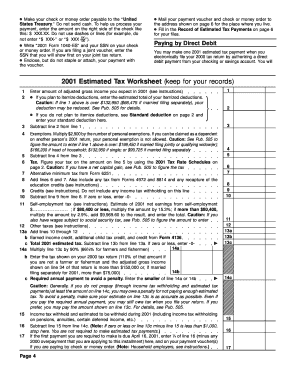

- Refer to the Estimated Tax Worksheet on page 4 of the form. Start by entering your expected adjusted gross income for 2001 in line 1.

- If you plan to itemize deductions, enter that total in line 2; otherwise, enter the standard deduction applicable to your filing status.

- Subtract the amount from line 2 from line 1 and enter the result in line 3.

- Multiply the number of personal exemptions by $2,900 (or applicable adjustment if you can be claimed as a dependent), and enter that amount in line 4.

- Calculate your tax based on the amount in line 5 using the 2001 Tax Rate Schedules provided in the form.

- Add any applicable additional taxes from Form 4972 or Form 8814 in line 6.

- Account for any credits on line 9, and subtract this from the total in line 8. Enter the result in line 10.

- Determine if you owe any self-employment tax and enter that amount in line 11 if applicable.

- Finally, calculate your total estimated tax by following the instructions for lines 13 through 14c. This will indicate the payment you need to make.

- Review your form for accuracy, save your changes, and then choose to download, print, or share the form as needed.

Complete your documents online and ensure you're ready for any tax obligations.

Related links form

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.