Loading

Get Az Form 352 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Form 352 online

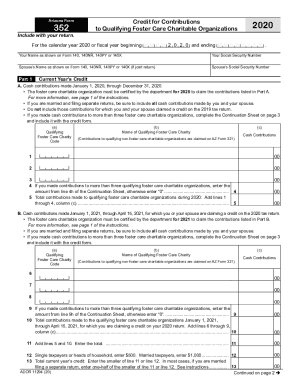

Filling out the AZ Form 352, which pertains to credits for contributions to qualifying foster care charitable organizations, can be streamlined by completing the form online. This guide will walk you through each section of the form, providing clear instructions to ensure accurate submissions.

Follow the steps to complete the AZ Form 352 seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the necessary fields for completion.

- Begin with Part 1, titled 'Current Year’s Credit'. Here, you will need to enter cash contributions made between January 1, 2020, and December 31, 2020. Ensure that the charitable organization is certified for this year.

- If you have made contributions to more than three organizations, complete the provided Continuation Sheet and attach it to the form.

- Proceed to Part B and repeat the process for cash contributions made between January 1, 2021, and April 15, 2021. Follow the same structure for listing organizations and contributions as in Part A.

- Tally the total contributions from both parts in line 11 and continue with the instructions for determining your current year’s credit in line 12.

- After completing all relevant sections, ensure all amounts are correctly entered and review the entire form for accuracy.

Start filling out your AZ Form 352 online today for a smooth submission process.

Related links form

The tax credit is claimed on Form 321. The maximum QCO credit donation amount for 2023: $421 single, married filing separate or head of household; $841 married filing joint.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.