Loading

Get Ic-831 Form 4466w Wisconsin Corporation Or Pass-through Entity Application For Quick Refund Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IC-831 Form 4466W Wisconsin Corporation Or Pass-Through Entity Application For Quick Refund Of online

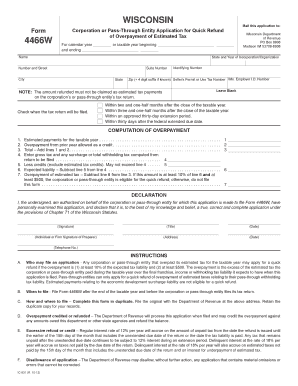

The IC-831 Form 4466W is an application used by corporations or pass-through entities in Wisconsin to request a quick refund of overpaid estimated taxes. This guide provides a comprehensive, step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete the IC-831 Form 4466W online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the calendar year or taxable year fields at the top of the form. Be sure to enter both the beginning and ending dates for the relevant tax period.

- Provide the state and year of incorporation or organization, along with the legal name and address of the corporation or pass-through entity. Include suite number, street address, city, state, and zip code.

- Enter the identifying number as well as any applicable seller’s permit, use tax number, or Wisconsin employer identification number.

- Indicate when the tax return will be filed by checking the appropriate box related to the filing timeline.

- In the computation of overpayment section, fill in the required fields about estimated payments and overpayments from the prior year. Make sure to calculate totals accurately as you proceed to line 3.

- For line 4, enter the gross tax and any surcharge or total withholding tax that you expect to have.

- On line 5, list any credits, excluding estimated tax credits, up to the limit of the amount from line 4.

- Calculate the expected liability by subtracting line 5 from line 4 and enter that amount on line 6.

- Determine the overpayment of estimated tax by subtracting line 6 from line 3 on line 7. Ensure the amount qualifies for a quick refund.

- Complete the declaration section by including the authorized signature, title, date, and information about the preparer if applicable.

- Review all entries for accuracy, then save changes, download, print, or share the completed form as necessary.

Start filling out your IC-831 Form 4466W online today for a quick refund of your overpaid taxes.

Use paper clips instead. • Mail return to: Wisconsin Department of Revenue, PO Box 8965, Madison WI 53708-8965. The return must cover the same period as the partnership's federal income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.