Loading

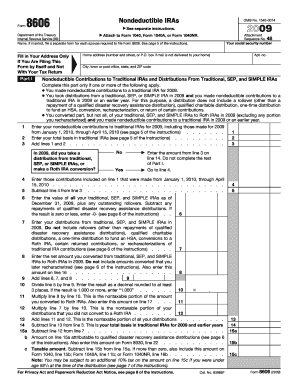

Get 2009 Form 8606. Nondeductible Iras

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Form 8606. Nondeductible IRAs online

Filling out the 2009 Form 8606 is essential for individuals who made nondeductible contributions to traditional IRAs. This guide provides clear, step-by-step instructions to help users accurately complete this form online.

Follow the steps to fill out the 2009 Form 8606 online effectively.

- Press the 'Get Form' button to access the 2009 Form 8606 and open it in your preferred document editing tool.

- Fill in your name and social security number at the top of the form. If you are married, ensure to file a separate form for each spouse who needs to submit Form 8606.

- Complete Part I if you made nondeductible contributions to a traditional IRA for 2009 or took distributions from a traditional, SEP, or SIMPLE IRA.

- In Part I, enter the amount of your nondeductible contributions for 2009 on line 1. Include any contributions made between January 1, 2010, and April 15, 2010.

- On line 2, enter your total basis in traditional IRAs. Add the amounts from line 1 and line 2 and enter the total on line 3.

- If applicable, indicate if you took a distribution from traditional, SEP, or SIMPLE IRAs in 2009 by answering line 4.

- Follow lines 5 to 15, entering the appropriate values for distributions and conversions, ensuring to complete the calculations as detailed in the instructions.

- Complete Part II if you converted any amount from traditional, SEP, or SIMPLE IRAs to Roth IRAs in 2009, providing the necessary amounts as specified.

- If you took any distributions from Roth IRAs, complete Part III by detailing nonqualified distributions and providing your basis in distributions.

- Review the entire form for accuracy, ensuring all entries are correct based on the instructions provided.

- Save your changes, and then download or print the completed form as needed for submission. Ensure you file it with your Form 1040 or other applicable tax return.

Complete your 2009 Form 8606 online today to ensure your nondeductible IRA contributions are accurately reported.

We need it to ensure that taxpayers are complying with these laws and to allow us to figure and collect the right amount of tax. You are required to give us this information. Who Must File. —You must file Form 8606 for 1987 if you make nondeductible contributions to your IRA(s).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.