Get Irs W-3c (pr)_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-3C (PR)_DSA online

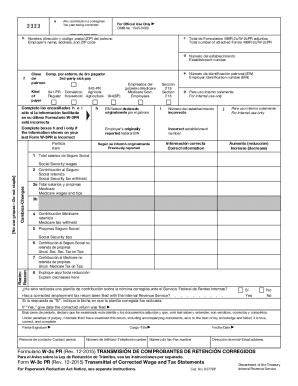

Filling out the IRS W-3C (PR)_DSA form is essential for employers who need to transmit corrected wage and tax statements. This guide provides a comprehensive, step-by-step overview to assist you in accurately completing the form online.

Follow the steps to successfully complete the IRS W-3C (PR)_DSA form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year being corrected in the appropriate field. This should reflect the year of the records that need adjustment.

- Input the employer’s name, address, and ZIP code correctly in the designated boxes.

- Complete boxes h and i only if the information from your last Form W-3PR is incorrect. In box h, enter the originally reported federal Employer Identification Number (EIN). In box i, indicate the total number of attached Forms 499R-2c/W-2cPR.

- If applicable, fill out the establishment number and confirm the EIN in their respective fields.

- Detail any changes in amounts by entering the correct figures for Social Security wages, Medicare wages, and any withheld taxes. Include reasons for any increases or decreases in the designated section.

- Indicate whether a corrected employment tax return has been filed with the Internal Revenue Service, and provide the date if applicable.

- Affirm the accuracy of the form by signing and dating it. Provide contact information including a phone number and email address.

- Finally, review the completed form for any errors before saving your changes. You may then choose to download, print, or share the form as needed.

Begin completing your IRS W-3C (PR)_DSA form online today to ensure accurate reporting.

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts. What is a W-3 Form? | BambooHR bamboohr.com https://.bamboohr.com › resources › hr-glossary › f... bamboohr.com https://.bamboohr.com › resources › hr-glossary › f...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.