Loading

Get Irs 1040 - Schedule 1 (sp)_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

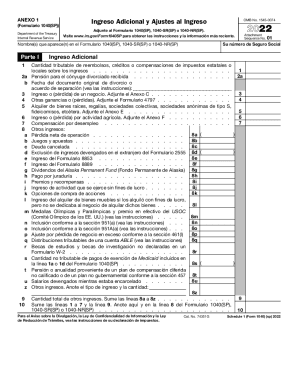

How to fill out the IRS 1040 - Schedule 1 (SP) online

Filling out your IRS 1040 - Schedule 1 (SP) is a crucial step in your tax preparation process. This guide will provide you with clear and supportive instructions to help you navigate and complete the form accurately online.

Follow the steps to fill out the IRS 1040 - Schedule 1 (SP) online:

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your Social Security number in the designated field. This number is essential for tax processing.

- Fill in your name as it appears on Form 1040(SP), 1040-SR(SP), or 1040-NR(SP).

- Proceed to Part I: Additional Income. Here, report your taxable refunds, credits, or compensations from state and local taxes on line 1.

- On line 2a, provide the amount for alimony received as specified. Also, include the date of the original divorce or separation agreement.

- For line 3, document any income or loss from business activity, attaching Schedule C if necessary.

- Continue to report other gains or losses on line 4, referencing Form 4797 as needed.

- On line 5, list rental income from real estate or royalties, or any partnerships, attaching Schedule E.

- For line 6, indicate any income or losses from farming activities, attaching Schedule F if applicable.

- Report any unemployment compensation you received on line 7.

- In line 8, report miscellaneous income types as applicable, noting the type of income and amount.

- Calculate the total of all other income reported on line 9.

- Sum the lines as instructed and record this total on line 8 of the main Form 1040(SP), 1040-SR(SP), or 1040-NR(SP).

- Move to Part II to report adjustments to income, starting with educator expenses in line 11.

- Include relevant business expenses for reservists and performing artists on line 12, attaching Form 2106.

- Document contributions to health savings accounts on line 13, including any required attachments.

- For deductions associated with retirement plans, adjustments, and other categories, fill in the appropriate lines as guided.

- After completing all entries, review the form for accuracy before saving.

- Finally, save changes to your document, and consider downloading, printing, or sharing the filled form as needed.

Ready to tackle your tax documents? Start filling out the IRS 1040 - Schedule 1 (SP) online today!

To find out how much you paid in a given year, pull up your 1040 tax form and look at line item 16, labeled your "total tax." Line item 17 shows how much was withheld from your paychecks for federal taxes in a year, and line 16 shows how much you paid in total after receiving your refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.