Loading

Get Ct Sba-12 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT SBA-12 online

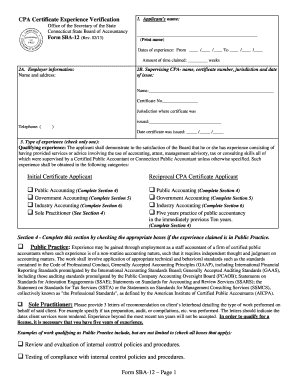

The CT SBA-12 form is essential for individuals seeking certification as Certified Public Accountants in Connecticut. This guide will walk you through the steps of completing this online form effectively and accurately.

Follow the steps to fill out the CT SBA-12 form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the applicant's full name in the designated field. Ensure that this matches the official identification.

- Input the dates of experience: specify the start date and end date of the professional experience. It is crucial that this experience was acquired no earlier than ten years prior to filing the form.

- Provide employer information, including the name and address of the firm where the experience was gained.

- Select the type of experience by checking only one box: Public Accounting, Government Accounting, Industry Accounting, or Sole Practitioner. This choice is crucial as it directs the subsequent sections to be filled.

- Complete Section 7 by checking 'Yes' or 'No' for each statement related to the content of the applicant's accounting experience.

- For Section 8, have the verifier provide their status and sign the form. The verifier must meet specific requirements outlined in the documentation.

Complete your CT SBA-12 form online today to ensure a smooth application process for your CPA certification.

In Connecticut, a CPA can expect to earn a competitive salary. On average, CPAs in CT make around $80,000 to $100,000 annually, depending on their experience and the specific area of accounting they work in. This well-paying career path can offer substantial financial benefits, especially when leveraging the CT SBA-12 requirements for unique opportunities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.