Get Nyc Dof Cr-a 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF CR-A online

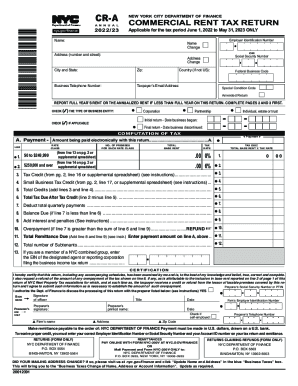

Filling out the NYC DoF CR-A form is essential for landlords subject to the commercial rent tax. This guide provides step-by-step instructions to help you navigate the process effectively and ensure your submission is accurate.

Follow the steps to complete your NYC DoF CR-A online.

- Press the ‘Get Form’ button to retrieve the form and open it in your editor.

- Begin by entering your name in the designated field. If there has been a name change, select the appropriate option.

- Fill in your Employer Identification Number (EIN) or Social Security Number (SSN) where prompted.

- Enter your business address, including the street, city, state, and zip code. Ensure accuracy to avoid issues with correspondence.

- Provide your business telephone number and taxpayer's email address for communication regarding your submission.

- Indicate the type of business entity by checking the appropriate box (partnership, individual, corporation, etc.).

- Select if this is an initial or final return, and enter the relevant dates as required.

- For the computation of tax, begin by reporting the full year's rent or the annualized rent for a partial year in the fields provided.

- Complete pages 2 and 3 first, providing required information about the premises, gross rent, and any applicable deductions.

- After filling out all necessary fields and sections, review the information for accuracy.

- Once satisfied, save your changes, and choose to download, print, or share the completed form as needed.

Complete your NYC DoF CR-A form online to ensure your tax obligation is properly recorded and managed.

tenants This tax is charged to tenants who occupy or use a property for commercial activity in Manhattan, south of the center line of 96th Street and pay at least $250,000 each year in rent. Commercial Rent Tax | City of New York - NYC Business nyc.gov https://nyc-business.nyc.gov › nycbusiness › description nyc.gov https://nyc-business.nyc.gov › nycbusiness › description

Fill NYC DoF CR-A

(b2) must be filed with the Department of Finance within. 180 days from the rent commencement date. We offer a number of online services to fit your busy lifestyle. Download the form and save to your device before filling in your information. Do not fill in your information if the form opens up in a web browser. Legal publisher offering ordinance codification services for local governments, specializing in providing codes of ordinances in print and on the Internet. Alert your clients, customers, or constituents about the mailing and encourage those who receive letters to reply and get the EITC they earned. Download the form and save to your device before filling in your information. Do not fill in your information if the form opens up in a web browser. New York City Department of Finance collects revenues, including taxes and fines, for the city that funds each public service.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.