Loading

Get Irs 990 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 online

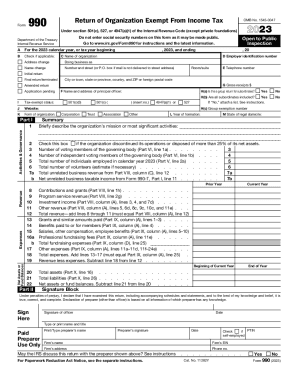

Filing the IRS 990 is a crucial requirement for many tax-exempt organizations. This guide provides clear, step-by-step instructions to help users complete the form efficiently and accurately, ensuring compliance with IRS regulations.

Follow the steps to fill out the IRS 990 online.

- Press the ‘Get Form’ button to access the IRS 990 form and open it in your chosen editor.

- Fill in the organization's essential information in the header section, including the name, employer identification number, and address. Ensure all provided details are accurate and complete.

- Complete Part I, which includes describing the organization’s mission and noting any significant changes in operations or activities.

- In Part II, summarize key services that the organization has provided and list total numbers of voting members, employees, and volunteers to give an overview of the organization's activities.

- For Part III, provide details on program service accomplishments. This section requires insight into the organization’s key projects and their outcomes.

- Proceed to Part IV, where you will complete a checklist of required schedules based on your organization’s activities and grant classifications.

- In Part V, address statements regarding other IRS filings and compliance. This involves confirming details about employee taxes and foreign accounts.

- Complete Part VI, which focuses on governance, management, and disclosures. Provide information about the governing body's composition, policies, and organizational changes.

- For Parts VII and VIII, report compensation details for officers and key employees, along with the organization’s revenue sources.

- In Part IX, outline the functional expenses incurred, detailing how funds were allocated across program services, management, and fundraising activities.

- Continue with Part X, which requires you to present a balance sheet. This section summarizes your organization’s assets, liabilities, and net assets.

- Finish with Parts XI and XII, which involve reconciling net assets and financial statements. Ensure any necessary explanations are documented in Schedule O.

- After completing the form, save your changes. You can download, print, or share the IRS 990 form as needed.

Complete your IRS 990 form online today to ensure timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The 990 is a public document that you can search for on the websites for the Secretary of State or the Attorney General where the organization is incorporated. In addition, 990s are available from a variety of open source and subscription sources. You may also request them from an organization or from the IRS.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.