Loading

Get Ny Dtf Ct-222 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-222 online

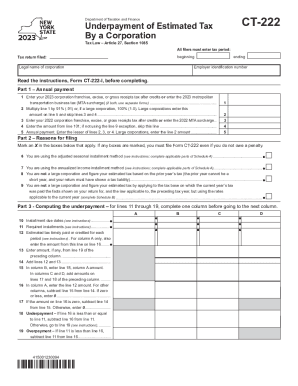

The NY DTF CT-222 form is essential for corporations to report underpayment of estimated tax. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete the NY DTF CT-222 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the tax period by filling in the 'beginning' and 'ending' dates at the top of the form.

- Input the legal name of the corporation and the employer identification number (EIN) in the designated fields.

- In Part 1, calculate your annual payment by entering the corporation franchise tax after credits or the MTA surcharge for the tax year 2023 on line 1.

- On line 2, multiply the amount from line 1 by 91% for regular corporations or 100% for large corporations.

- If applicable, enter the amounts for lines 3 and 4 as per the previous year's tax calculations.

- On line 5, indicate the lesser of lines 2, 3, or 4 for annual payment. Large corporations will use line 2.

- In Part 2, select any reasons for filing by marking an 'X' in the corresponding boxes. This is essential even if no penalty is owed.

- Proceed to Part 3 to compute the underpayment. Complete one column from lines 10 through 19 before moving to the next column.

- Lastly, after reviewing all entries, ensure to save your changes, download, print the form, or share it as needed.

Complete your documents online with confidence by following these comprehensive steps.

The penalty for late payment or underpayment of income or use tax is 10% of the tax due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.