Loading

Get Instructions For Form It-230 - Tax.ny.gov - New York State

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Instructions For Form IT-230 - Tax.NY.gov - New York State online

Filling out tax forms can be daunting, but with the right guidance, you can complete the Instructions For Form IT-230 with ease. This guide offers clear steps and supportive information to help you navigate the process effectively.

Follow the steps to successfully complete Form IT-230.

- Press the ‘Get Form’ button to obtain the form and access it in your editor.

- Begin by entering your name as it appears on your tax return and your identification number in the designated fields.

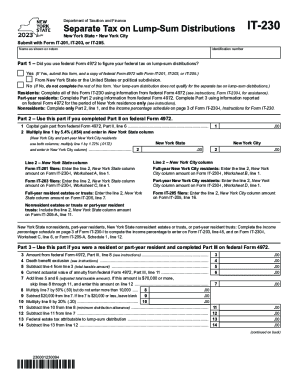

- For Part 1, indicate whether you used federal Form 4972 to figure your federal tax on lump-sum distributions. If yes, submit this form along with a copy of federal Form 4972. If no, do not continue with the form.

- Complete Part 2 if applicable, using the relevant figures from federal Form 4972. For example, multiply the capital gain amount from line 1 by 5.4% for New York State, and if you're a full-year New York City resident, also calculate using the New York City column.

- Follow instructions for Part 3 if you spent any time as a resident. Carefully subtract and calculate amounts as indicated, following the lines of the form.

- If you reach the 10-year tax option section, perform the necessary calculations and input your results in the appropriate lines.

- Once you complete all parts of the form, save your changes. You can download, print, or share the completed form as needed.

Complete your tax documents online today to ensure timely filing!

T1198s are issued to individuals who received a pay equity payment of $3,000 or more (excluding interest); if you received more than $3,000 total, but less than $3,000 excluding interest, you will not receive a T1198.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.