Loading

Get Ny It-601 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-601 online

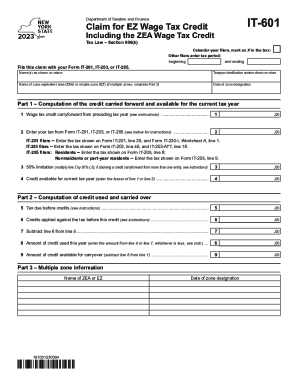

The NY IT-601 form, also known as the Claim for EZ Wage Tax Credit, is a crucial document for users seeking to claim a wage tax credit. This guide provides step-by-step instructions to help you accurately complete the form online.

Follow the steps to fill out the NY IT-601 online:

- Press the ‘Get Form’ button to acquire the NY IT-601 form and open it in your editor.

- Begin by indicating your filing status. If you are a calendar-year filer, mark an X in the designated box. For other filers, enter the tax period by specifying the beginning and ending dates.

- Provide your name as it appears on your tax return. Ensure this matches to avoid processing delays.

- Enter your taxpayer identification number exactly as shown on your return.

- Identify the name of the zone equivalent area (ZEA) or empire zone (EZ) pertinent to your claim. If there are multiple zones, you will need to complete Part 3.

- Input the date of zone designation, which is essential for your claim.

- Move to Part 1 to compute the credit carried forward. Start with line 1, entering the wage tax credit carryforward from the preceding tax year.

- On line 2, enter your tax amount from the applicable form (IT-201, IT-203, or IT-205). Follow the instructions provided for each form to ensure accuracy.

- Calculate the 50% limitation on line 3 by multiplying the amount on line 2 by 0.5.

- On line 4, determine the credit available for the current tax year by entering the lesser amount from line 1 or line 3.

- Proceed to line 5 and input the tax due before credits, as instructed.

- Enter any credits applied against the tax before this credit on line 6.

- Subtract line 6 from line 5 and record the result on line 7.

- On line 8, enter the amount of credit you plan to use this year, which should be the lower value from line 4 or line 7.

- Calculate the amount of credit available for carryover on line 9 by subtracting line 8 from line 1.

- If you have multiple zones, complete Part 3 by providing the names and dates of zone designation for each.

- Review all completed sections for accuracy before finalizing your document. Once satisfied, save your changes, download, print, or share the completed form as needed.

Complete your NY IT-601 form online today to ensure you receive your EZ Wage Tax Credit.

General Qualifications To qualify for the 2022 EITC, you must: Have earned income in 2022 through full- or part-time work or self-employment. Be legally authorized to work in the United States.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.