Loading

Get Ny It-633 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-633 online

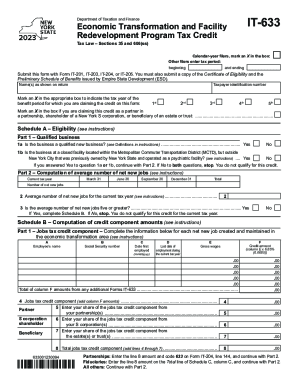

The NY IT-633 form is essential for claiming tax credits under the Economic Transformation and Facility Redevelopment Program in New York. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete your NY IT-633 form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Indicate whether you are a calendar-year filer by marking an X in the box. If you are not a calendar-year filer, enter the tax period's starting and ending dates.

- Provide your name(s) as shown on your return and enter your taxpayer identification number.

- Mark an X in the box corresponding to the tax year of the benefit period for which you are claiming the credit.

- If applicable, mark the box confirming that you are claiming this credit as a partner in a partnership, shareholder of a New York S corporation, or beneficiary of an estate or trust.

- Proceed to Schedule A—Eligibility. Here, answer questions 1a and 1b to determine if your business qualifies. If you answered yes to either question, continue to Part 2.

- In Part 2, compute your average number of net new jobs. Fill in the number of net new jobs for each quarter and calculate the total.

- Indicate whether the average number of net new jobs is five or greater. If yes, complete Schedule B; if no, you do not qualify for this credit.

- Complete Schedule B by providing details for each net new job created and maintained in the economic transformation area. Calculate the total jobs tax credit using the credit amount formula.

- Continue filling out portions for investment tax credit component, training tax credit component, and real property tax credit component as applicable, entering all required details.

- Review your entries and ensure all calculations are correct. Total each section as required.

- Once all sections are complete, save your changes, download the form, and prepare to print or share as needed.

Complete your NY IT-633 form online today to ensure you receive the tax credits you deserve.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.