Loading

Get Irs W-3pr 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-3PR online

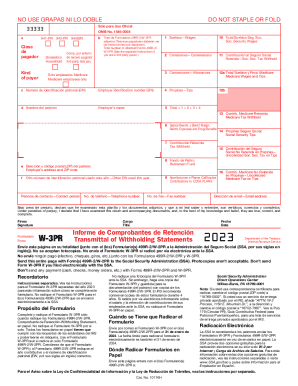

The IRS W-3PR form is a transmittal form used for reporting employee wage and withholding information. Completing this form accurately is essential, as it accompanies Forms 499R-2/W-2PR. This guide will walk you through the process of filling out the W-3PR form online.

Follow the steps to complete your W-3PR form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the kind of payer by checking the appropriate box that describes your business type, such as household or third-party payer.

- Enter the total number of Forms 499R-2/W-2PR you are submitting. This ensures the SSA receives all relevant documents.

- Fill out the total wages you are reporting in the designated fields (e.g., wages, commissions, tips). Make sure these amounts are correctly calculated.

- Provide your employer identification number (EIN), ensuring it is accurate for proper processing.

- Complete the employer's name and address section, including ZIP code, and ensure these details are correct for correspondence.

- Declare under penalties of perjury by reviewing the statement provided and signing the form. Add your title and date the form.

- Once completed, save the changes you've made. You will have the option to download, print, or share the form with your records.

Complete your IRS W-3PR form online today to streamline your filing process.

Again, the answer is no – they are different forms. While Form W-2 and Form W-3 are used to report employee wages, Form 1099 is used to report non-employee (AKA freelancer or independent contractor) compensation for the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.