Loading

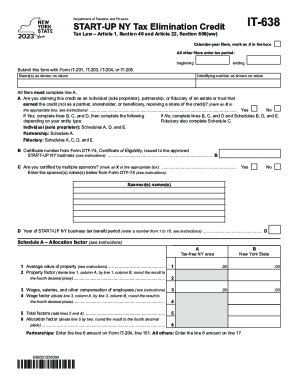

Get Form It-638 Start-up Ny Tax Elimination Credit Tax Year 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-638 START-UP NY Tax Elimination Credit Tax Year 2023 online

Filling out the Form IT-638 for the START-UP NY Tax Elimination Credit can be straightforward with the right guidance. This comprehensive guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to successfully fill out the Form IT-638.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Indicate your filing status by checking the appropriate box for calendar-year filers or entering the tax period dates. Ensure you submit this form with your main tax form (IT-201, IT-203, IT-204, or IT-205).

- Complete line A, indicating whether you are claiming the credit as an individual (sole proprietor), partnership, or fiduciary. Mark an X in the box that applies to you.

- If you answered 'Yes' to line A, provide the necessary details, including the certificate number from Form DTF-74. If you answered 'No,' complete lines B, C, and D along with the relevant schedules accordingly.

- For Schedule A, fill out the allocation factor, starting with the average value of property and calculating the property factor, wage factor, and total factors as per the provided instructions.

- If applicable, proceed to complete Schedule B with details regarding partnerships, S corporations, or estates/trusts. Ensure to enter all required entity information accurately.

- Complete Schedule C if you are a fiduciary. List the total income from the START-UP NY business, and itemize the share of income allocated to beneficiaries.

- Fill out the tax factor in Schedule D, including necessary calculations for the tax due and the allocation of income within New York State.

- Finally, complete Schedule E to compute the total credit, summarizing the amounts from previous sections and ensuring all calculations align with provided guidelines.

- Review the completed form for accuracy, then proceed to save your changes, download, print, or share the form as needed.

Start filling out your Form IT-638 online today to ensure you receive your tax elimination credit!

If you earned income in 2022 from investments, such as rental property or stocks, the amount must be $10,300 or less to qualify for the EITC. If you have no children, you must be age 19 or older. If you are: Single, you must earn less than $16,480.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.