Loading

Get Irs 8865 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8865 online

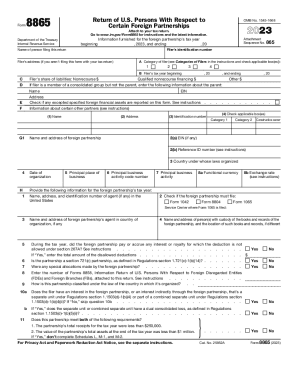

The IRS 8865 is a crucial form for U.S. persons with interests in certain foreign partnerships. Completing this form accurately ensures compliance with tax obligations related to foreign partnerships. This guide will provide you with a comprehensive walkthrough to assist you in filling out the IRS 8865 online.

Follow the steps to complete the IRS 8865 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the Filer’s identification number and the name of the person filing the return in the designated fields.

- Select the category of filer by checking the appropriate box(es) corresponding to the Categories of Filers criteria.

- Provide the Filer’s address if this form is not being filed with your tax return. Otherwise, leave this section blank.

- Fill in the Filer’s tax year by entering the beginning and ending dates in the provided fields.

- Input the Filer’s share of liabilities, including Nonrecourse and Qualified nonrecourse financing amounts.

- If applicable, provide the details of the consolidated group by entering the name, EIN, and address of the parent entity.

- Complete the section on other partners by entering their names, addresses, and identification numbers as required.

- Provide information regarding the foreign partnership, including its name, address, organization country, and principal place of business.

- Fill out the functional currency information and exchange rates required for the foreign partnership’s tax year.

- Complete the questions concerning any interest or royalties paid, classifications, and any applicable foreign financial assets.

- Sign and date the form as required, ensuring that all information is true and complete.

- At the final step, save any changes, and choose to download, print, or share the form for your records.

Begin completing your IRS 8865 online today to ensure proper reporting of your foreign partnership interests.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Form 8865 is a counterpart to Form 5471. While Form 5471 is used to report foreign corporations, Form 8865 is used to report foreign partnerships.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.